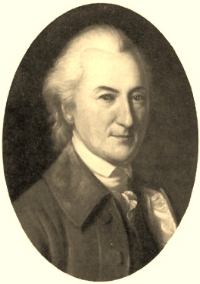

In his 1767-68 "Letters From A Farmer In Pennsylvania," John Dickinson wrote:

The old maxim of the law is drawn from reason and justice...They who feel the benefit, ought to feel the burden.

No better standard can be cited for the foundation of a fair system of taxation. However, present policy and proposed "reforms" offered by Congressional leaders simply further invert the relationship between the ability to pay and tax incidence.

The current IRS code is a bloated and arcane set of documents that serves as full employment program for tax attorneys and accountants but fails to serve the public interest.

The federal tax code is the purest example of the power of big-money special-interests to purchase, or rent, government for their own private benefit. It is a direct product of the corrupt pay-to-play campaign financing scheme that distorts policy making.

The basic principles that should govern a program of “taxation with representation” are:

- Fairness. Fairness requires that persons with similar incomes and assets should be taxed alike. Fairness also requires that those who have more should pay more than those who have less.

- Simplicity. A tax system is unsuitable for a democratic republic if it cannot be understood by the taxpayers themselves. Our present tax system is exceedingly complex and demands simplification.

- Fiscal Goals. A tax system should be used primarily to raise revenue. It should not be used to subsidize business activity or to influence personal conduct.

- Efficiency. Tax deductions, credits and exclusions usually confer their greatest benefit on wealthier persons and give little or no help to those who are desperately in need. The most efficient way to implement government programs is through direct appropriations, which are subject to annual budget review, and which relate benefits to needs. Tax subsidies should be rejected because they waste scarce government resources and are seldom subject to budget review.

- Burden Shifting. When tax breaks allow others to escape their fair share of the tax burden, others have to pay more to make up the difference. This shifting of tax burdens is an important source of the unfairness in the federal tax system. It must be halted.