Simplification?

At 515 pages the Senate version of the Republican tax-reform is 86 pages longer than the House version. Clearly this legislation is not designed to simplify the tax-code.

Fiscal responsibility?

The federal government is currently operating in the red to the tune of over $700 billion this year. All reputable analyst project the legislation will add over one trillion dollars to the debt. The national debt is already at a record peace-time high and interest is 7% of mandatory spending. Clearly this legislation is reckless and fiscally irresponsible.

Help the economy?

The economy is cruising along at a modest and healthy 3% growth rate. Unemployment is at record lows and wages are on the rise. The stock market is in the stratosphere, having tripled since the 2009 lows. In July S&P projected that US companies will post record profits for 2017. The only sour notes in the economy are rising personal debt, the cost of healthcare, and the growing disparity between the richest and poorest Americans. This legislation throws fuel on the fires of irrational exuberance while dousing the hope of solving serious economic concerns. Clearly this legislation a dangerous attack on the stability of the US economy.

Give people more money to spend?

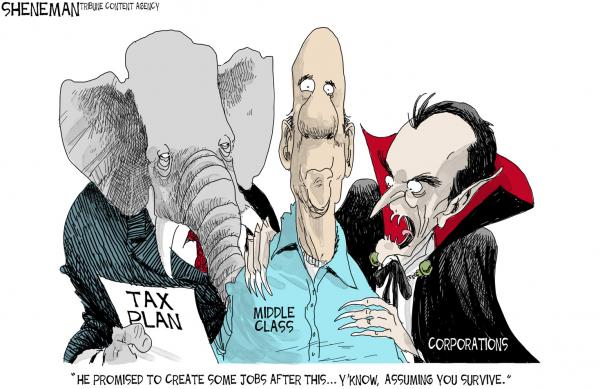

This legislation addresses individual income tax and corporate taxes. It does not address payroll and self-employment tax. 45.7% or almost 78 million tax-payers pay no individual income tax. Doubling the standard deduction will increase the ranks of those not paying any income tax to over half of all tax payers. Effectively those Americans making the median income or less will pay no income tax. But since few do now, this will have negligible impact on reducing middle income taxes. Projections are that those families making between $50,000 and $100,000 may see an average of maybe $50 per month in their take-home income. But most of that will be erased by higher insurance premiums resulting from ending the mandate, and the elimination of other popular deductions. Clearly the promise of more money for the middle class is exaggerated at best.

Stimulate business expansion?

Republicans claim lowering the corporate tax rate from 35% to 20% will encourage business to expand in our country which, in turn will increase wages and improve employment. But surveys of business owners indicate they will use the savings to buy back stock and pay down debt to increase capitalization rather than increase wages or hire more employees. Another relevant fact is that in 1952, corporate income taxes accounted for 33 percent of all federal tax revenue and today, despite record-breaking profits, corporate taxes bring in less than 9 percent. Clearly, government taxation of corporations is not a problem that needs fixing.

Historical perspective?

Reagan cut taxes and regulations, the national debt tripled, and we went into recession before Congress raised taxes. GW Bush cut taxes and deregulated financial markets, and we went into the great recession and are still experiencing enormous deficits ($700 billion this year). Both of those presidents used the same trickle-down rhetoric being used today to scam the American public into believing a lie. If this tax-cut package passes, a severe recession will soon follow, and federal deficits will reach new highs. Clearly, "voodoo economics," as George H Bush called it, is economy destroying policy.

Drown government in a bathtub?

The real agenda is to bankrupt government so major public programs, highways, Social Security, Medicare, the Post Office, education, and parks can be auctioned off in a fire sale to be pofitised by Wall-Street brokers. When Congress passed the 2001 Bush tax-cut package; Norquist crowed: “I don't want to abolish government. I simply want to reduce it to the size where I can drag it into the bathroom and drown it in the bathtub.”

Clearly, this is the agenda of a wealthy elite and political insiders to bankrupt government.